2025 Year End Tax Savings and Special Offers

For small business owners, Q4 is often the busiest time of the year. In addition to running your business during the holiday season, you are also doing your year-end tax planning.

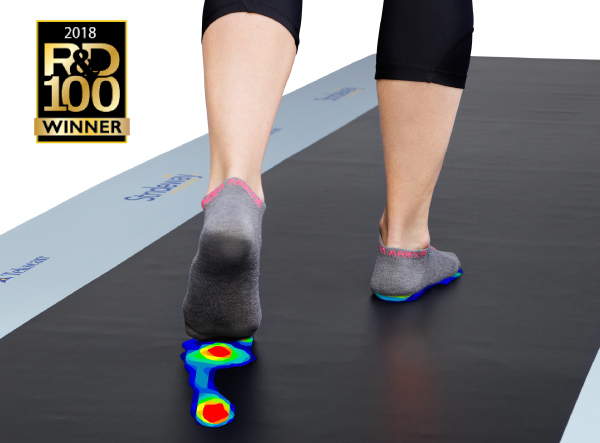

At Tekscan we always see increased interest in sales of our medical and dental products to clinicians who are small business owners because of the tax advantages of year end purchases. It is the perfect time of year to finally buy that gait analysis system (walkways, in-shoe, portable) or Mat systems for balance and stability; or T-Scan™ digital occlusion system you have wanted for your practice.

Section 179 Tax Benefits for Business Owners

Section 179 Tax Benefits for Business Owners

If you haven't already started talking to your accountant about year-end tax planning, you may not have been considering the valuable tax benefits the IRS offers under Section 179 for capital purchases. If you purchase a depreciable asset like a Tekscan gait analysis or mat foot function system or a T-Scan digital occlusal system, you can reduce your tax liability in the current year by taking it as an immediate deduction rather than depreciating it over time.

Under IRS Section 179, you can take an immediate deduction for total equipment purchases, up to $1,250,000 in the 2025 tax year. (up from $1,220,000 in 2024).

You cannot have purchased capital equipment totaling more than $3,130,000 ($3,050,000 was the total limit in 2024), so this tax benefit is not for large corporations with massive capital expenditures. But it is perfect for small businesses and clinicians.

But do not take our word for it. Talk to your accountant and make sure your business can benefit from this program and the reduced tax liability in 2025.

T-Scan™ SystemObjective assessment tool to evaluate occlusion forces from both force and timing |

Previous Post: |